Do you know the principal ratios for evaluating shares?

Ratio analysis should be part of your information gathering process, especially if you’re investing on your own in corporate shares. Take the time to understand the ratios, what they mean, and what their limitations are.

The ratios may be based on historical data or future projections. Don’t forget that past performance does not guarantee future results and projections don’t always play out in reality.

Don’t base your investment decisions on ratios alone. The current and future value of a share is influenced by many factors, including some that are difficult to measure.

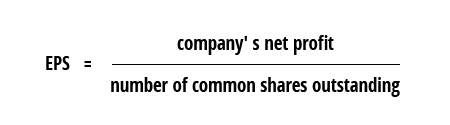

Earnings per share

Earnings per share (EPS) is the amount each shareholder would get per share if the company paid out all of its net profit to its shareholders.

EPS is calculated as follows:

The figures used to calculate EPS can be found in the company’s annual report or financial statementsFinancial statements are the accounting reports that provide an accurate picture of a company’s financial position for a given period. available on SEDAR+ This link will open in a new window.

For example, if a company’s net profit is $20 million and there are 10 million shares outstanding, its EPS would be $2.

EPS can tell you how companies in the same industry compare.

Pay particular attention to the following:

- Has a company’s EPS increased? Do you know why? Is the increase due to higher revenues or reduced expenses? EPS can also increase simply because the company buys back its own shares, thereby reducing the number of shares outstanding.

- EPS does not take into account such things as the company’s debt. Companies A and B, which operate in the same industry, can have the same EPS, but Company B may be more indebted, whereas Company A might be financially more sound.

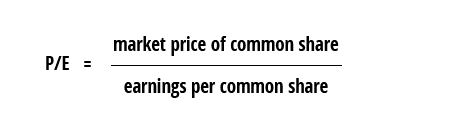

Price to earnings ratio

The price to earnings ratio (P/E) measures the relationship between the earnings of a company and its stock price.

P/E is calculated as follows:

This information can be found in the management’s discussion and analysis (MD&A)Management’s Discussion and Analysis (MD&A) is a document that explains management’s point of view on the company’s financial statements, financial condition and future prospects. This report complements the financial statements, but does not form a part of them. (often in the historical data section) available on SEDAR+ This link will open in a new window or the company’s website.

For example, a company’s stock sells for $30 per share and its net earnings per share are $2. That means it has a P/E ratio of 15 ($30 divided by $2). Investors are therefore willing to pay $15 for $1 in earnings per share of the company.

The P/E is commonly used to compare two stocks to see how they are being valued by the market. According to Investopedia This link will open in a new window, the average annual P/E of the S&P 500

This link will open in a new window has historically ranged from 13 to 15. For example, a company with a current average P/E of 25, above the S&P 500 average, trades for 25 times its earnings.

A higher P/E suggests that investors are willing to pay more per dollar of earnings today because they expect future earnings growth to exceed other companies. However, some investors consider a company with a high P/E to be overvalued.

Basing your investment decisions on the P/E alone is a risky, ill-advised practice.

Pay particular attention to the following:

- The earnings used to calculate the P/E are sometimes adjusted to exclude extraordinary events, as they are unlikely to recur. When reviewing the ratio, it is important to know if and how the earnings were adjusted and whether they are actual or future earnings.

- A company’s share price can be volatile. Its P/E on a given date may be affected by a brief period of euphoria or fear.

- Using the P/E to assess emerging companies can have its limits. A very high P/E ratio of 600 or more is difficult to interpret. Emerging companies often spend a lot of money on research, development and infrastructure during their early years, resulting in delayed or limited revenue gains. An emerging company may report losses for years before achieving high revenue growth. Conversely, it may be required to cease operations due to a lack of funding sources.

- P/E does not take such things as company debt into account.

- A low P/E can mean that a company is undervalued by the market in the short term and represents a buying opportunity for an informed investor. It can also mean that investors are shunning its shares because they anticipate problems or losses.

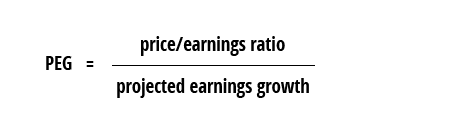

Price/earnings-to-growth ratio

The price to earnings ratio to growth ratio (PEG) is a metric that helps investors value a stock by factoring in a company’s market price, earnings and future growth prospects.

The PEG is calculated as follows:

Pay particular attention to the following:

- Future growth rates are estimates. Analysts often base their estimates on past growth rates and/or assumptions. Are you comfortable with the estimates and assumptions? Past growth rates are not always indicative of a company’s future prospects. Analysts’ assumptions could also be wrong.

Don’t perform this type of calculation if you don’t have the market knowledge needed to comfortably estimate the earnings growth rate. Projected earnings growth rates are calculated by rating agencies such as Standard & Poor's (S&P) This link will open in a new window, Moody’s

This link will open in a new window et Fitch Ratings

This link will open in a new window.

For example, a company with a P/E of 30 and projected earnings growth for next year of 15% would have a PEG of 2 (30 divided by 15). A company with a P/E of 30 but projected earnings growth of 30% would have a PEG of 1 (30 divided by 30).

The lower the number, the less you have to pay to benefit from the company’s projected earnings growth.

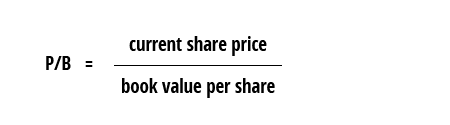

Price to book ratio (P/B)

The P/B ratio compares a company’s share price with its book value.

The P/B is calculated as follows:

Book value is the current value of the company’s equity (assets minus liabilities) as indicated in its annual report or financial statements.

For example, a P/B less than 1 means the stock is trading at less than the current value of the company’s equity.

Pay particular attention to the following:

- If a company’s share price is volatile, it may be difficult to interpret the P/B.

- The ratio can be low if the company has a lot of assets. However, the assets could be excess inventory the company is unable to sell.

- As with most ratios, you should compare the P/B ratios of similar companies. For example, it’s not useful to compare a service company and a manufacturer as service companies tend to have fewer assets than manufacturing companies.

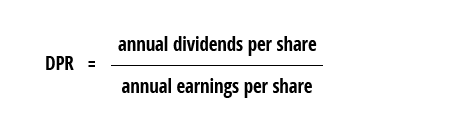

Dividend payout ratio

The dividend payout ratio (DPR) measures what a company pays out to investors in dividendsDividends are the portion of the earnings, after taxes, that a corporation distributes to shareholders in proportion to their holdings. per share compared with what the stock is earning.

The DPR is calculated as follows:

For example, if a company paid out $1 per share in dividends and had an EPS of $3, the DPR would be 33% (1 divided by 3).

Pay particular attention to the following:

- A company’s life cycle, investments in infrastructure, new developments in technology and recent acquisitions can affect its DPR.

- Mature companies usually have higher DPRs than growth companies that, because they don’t generate enough earnings to pay out dividends, have DPRs that are low or zero.

- A company may reduce or suspend dividend payouts if, for example, its profits are lower than expected or it needs to retain its earnings for one reason or another. Such decisions generally result in significant decreases in the company’s stock price.

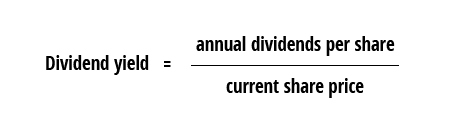

Dividend yield

The dividend yield indicates the return in dividends as a percentage of the stock price.

Dividend yield is calculated as follows:

Dividend yield tells you how much cash flow you’re getting for your money.

For example, suppose two stocks each pay an annual dividend of $1 per share. Company ABC’s stock is trading at $20, but Company XYZ’s stock is trading at $40. Company ABC has a dividend yield of 5% (1 divided by 20), while Company XYZ’s dividend yield is only 2.5% (1 divided by 40). At first glance, investors looking to use their portfolios to supplement their income would no doubt prefer ABC’s stock to XYZ’s since it yields twice as much dividend. But there are other factors that need to be considered.

Pay particular attention to the following:

- Growth companies that pay out few or no dividends are at a disadvantage when analyzed solely through the lens of dividend yield.

- High dividend payouts can be harmful to a company’s future growth. Each dollar that a company pays out to its shareholders is a dollar it doesn’t reinvest in things like research and development or plant upgrades.

- Sometimes a high dividend yield is the result of a share’s price decreasing. The dividend yield will mathematically rise because the stock price is dropping. Find out why share price has dropped before investing.