Mutual Fund Fees

When you invest in a mutual fund, you may be charged fees. These fees can vary considerably from one fund to the next. Be aware that higher fees are not synonymous with higher returns!

Check and compare fees before investing in a mutual fundA mutual fund is made up of money that is pooled by several investors and used on their behalf by a manager to buy shares, bonds or other securities in line with the fund’s objectives. . Remember, every dollar paid in fees is a dollar less in returns.

Whatever fund you choose, make sure that it matches your investor profile. When it comes time to invest in a mutual fund, understanding the product’s main features is very important. The document referred to as Fund Facts is an essential tool for making an informed decision.

The Fund Facts shows you the following fees and expenses:

- Purchase fee (the cost of purchasing units) and annual impact on each $1,000 invested;

- Redemption fee (the cost of selling units) and annual impact on each $1,000 invested;

- Management expense ratio (MER);

- Trading expense ratio (TER);

- Trailing commissions as a percentage.

Purchase fees

If you purchase units of certain mutual funds, either directly or through certain financial institutions, you will pay a purchase (“front-load”) fee. In this case, the fee is deducted from the total amount you invest when purchasing the units.

If a fund charges a purchase fee, it could be as high as 5% of your investment. For example, if you pay $1,000 and the applicable purchase fee is 5%, your net investment will be $950 ($1,000 - $50).

You can negotiate a lower fee with your representative, especially if you are investing a substantial amount. The maximum purchase fee is shown in the Fund Facts and simplified prospectusA simplified prospectus is an abbreviated prospectus that meets all the legal requirements and provides the information to which investors are entitled..

There are funds that do not charge a purchase fee. However, these funds do charge other fees. Management and operating fees are always charged.

Redemption fees (deferred sales charge)

Since June 1, 2022, redemption fees have been prohibited for mutual funds under Canadian Securities Administrators (CSA) rules.

For some mutual funds purchased before June 1, 2022, you will have to pay a redemption (back-load) fee when you sell your units. Redemption fees are calculated based on a percentage of the value of the fund units at the time of purchase or their value at the time of redemption.

For some funds purchased before June 1, 2022, the redemption fee may decrease progressively based on the number of years the units were held. For example, a redemption fee may be 6% the first year and decrease by 1% each year thereafter until it reaches zero after six years of holding the units.

Some mutual funds purchased before June 1, 2022 allow the redemption of an annual pre-established percentage of units at no charge, usually 10%.

You can sometimes exchange (switch) your units for those of another fund in the same fund family at no charge.

A number of funds are sold without back-load fees. However, these funds do charge other fees. Management and operating fees are always charged.

Management and operating fees

All mutual funds charge management and operating fees, regardless of whether or not they also charge purchase fees or redemption fees.

These fees are taken out of the fund’s assets. Therefore, although they reduce your return, they rarely appear on your statement of account.

Some mutual funds offer discounts that reduce the amount of fees charged to investors if the account value is higher than a pre-determined amount.

Management fees

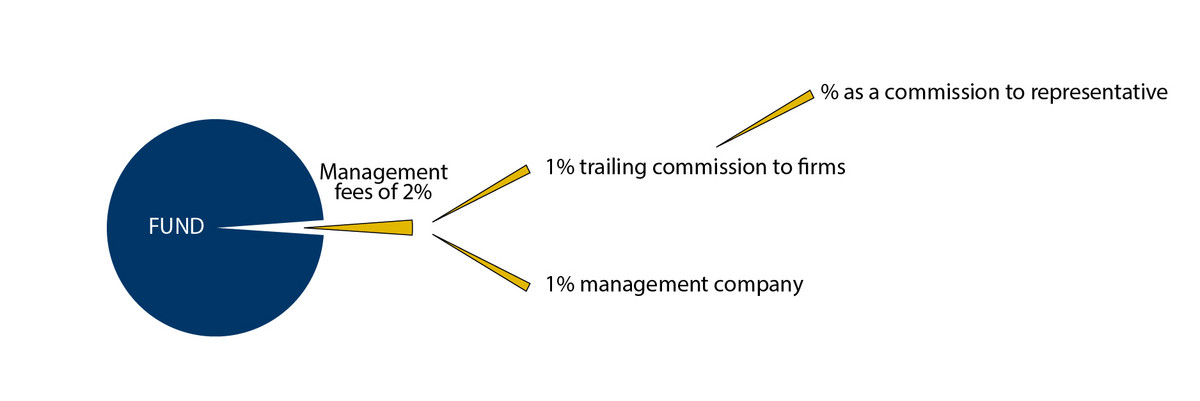

Management fees are generally calculated based on a set percentage of the fund’s assets under management. These fees cover such items as administration costs, portfolio management services, marketing fees and commissions paid to advisers.

Management fees are generally 1% to 3% and vary depending on:

- Fund type. For example, an equity fund is more expensive to manage than a money market fund because it requires more extensive analyses.

- Management style. A fund that is managed actively is more expensive that an index fund, which is managed passively.

- Type of distribution. Fund management companies that use brokerage firms to sell their funds must pay for their service.

The Fund Facts and simplified prospectusA simplified prospectus is an abbreviated prospectus that meets all the legal requirements and provides the information to which investors are entitled. indicate which portion of management fees is in the form of trailing commissions paid in particular to advisers to help you make informed investment decisions. Find out about the advice you are eligible to receive as a holder of mutual fund units.

As of June 1, 2022, trailing commissions may no longer be paid to dealers who do not make a suitability determination, such as online trading platforms that allow investors to buy and sell their investments on their own.

Your representative must give you the Fund Facts before you purchase your units.

F series funds

Some management companies offer F series funds. These funds do not charge trailing commissions and are intended for investors who pay their dealer directly (the company that they transact with and that employs their representative), e.g., based on a set percentage of their assets.

The management fees for these funds will therefore be lower.

If you are this type of investor, your representative must select F series funds; otherwise, the dealer will be remunerated twice (by you and by the fund management company).

End of the insightManagement expense ratio

The management expense ratio (MER) corresponds to the management and operating expenses as a percentage of the average net assets of the fund. It shows you the cost of administering and distributing the fund.

For example, if a fund with average net assets of $100 million has fees of $2 million per year, its MER will be 2%.

This percentage has a direct impact on the net performance of your funds. The higher your fund’s MER, the greater its impact on the fund’s net return.

Fees included

Management and operating expenses are deducted from the returns published by the fund.

End of the insightOperating fees

Operating fees vary between 0.1% and 0.5% of the fund’s net assets. They include:

- Audit and legal fees;

- Printing costs;

- Remuneration paid to the depositary;

- Bank fees;

- Cost of preparing and distributing the prospectus;

- Etc.

Some management companies charge their funds a fixed administration fee, calculated as a percentage of the funds’ assets, to cover fund operating expenses. This helps to better forecast the fund’s management and operating fees. All additional operating fees are absorbed by these management companies.

Trading fees

These are the fund’s transaction fees. They usually account for 0.05% of the fund’s net assets.

Other Fees

On occasion, funds may also charge other fees. For instance, some funds charge penalties for excessive trading, e.g., for buying and then redeeming or substituting (switching) units within 30 days.

For more information about these fees, consult the Fund Facts and simplified prospectus, or speak to your representative.

Any questions or dissatisfaction regarding this topic?

Contact us for information and assistance.

End of the Information