Ponzi schemes and pyramid investment schemes Ponzi schemes, pyramid investment schemes and gifting circles

Ponzi schemes involve taking an investor’s money to pay bogus returns to other investors or reimburse investors who want their money back. Fraudsters may therefore create the false impression that the investment is generating positive returns and you won’t have any problem recovering your investment.

Most Ponzi schemes are uncovered after the fraudsters vanish or are no longer able to meet investment withdrawal requests. By then it’s too late because the money is no longer in the accounts.

Ponzi schemes may be combined with one or more other types of fraud.

Example

You put $1,000 in an investment offered by Paul, a con artist. After only a week, you receive a $100 cheque from Paul, who explains that the amount is the income generated by your $1,000 investment.

Unfortunately, your $1,000 investment did not actually generate any return. Paul used a portion of your investment to pay you $100 in fake “profits.” By doing this, he is hoping to get you to pour more money into the investment or to convince others to invest in it. Paul is also using much of the money you’ve paid to him on personal expenses.

Pyramid investment schemes

A pyramid investment scheme is a system of selling products (investments, for example) that earns money from the recruitment of new members. The product sold is merely a pretext for recruiting members.

The “one-of-a-kind” investment doesn’t actually exist: the fraudsters use your money to pay you your investment income and recruitment commissions (Ponzi scheme). When they sense they’re about to get caught, they disappear with your money

People who use this technique won't tell you it’s a pyramid scheme.

This fraud has many variations.

Example

You’re offered a very promising investment that is expected to generate a high return. You have to hold the investment for a certain period of time (e.g., six months). In addition to the excellent return, you can make even more money by recruiting investors who will benefit from the same “one-of-a-kind” investment opportunity.

You may, for instance, be asked to recruit two people. For each person you bring in, you’ll receive a commission—usually a percentage of the amounts invested by the people you recruit. You will then pocket an additional commission for each investor who is enlisted by your recruits.

Does your advisor offer you to sell financial products and services? Would a significant portion of your revenue or commissions come from recruiting representatives and the sales they make?

It's not necessarily illegal, but beware, it has the appearance of a pyramid structure. You may be promised very high potential income and financial independence. The reality is that it takes a lot of time, and few people manage to generate enough money to make a living.

Gifting circles

You’ve been approached to join a mutual aid or lending group or maybe a group of insiders or special people. To become a member, you need to make a large ‘gift’, such as $5,000. In exchange, you could receive a much bigger amount by recruiting participants. Be careful! The offer might be a scam.

What is a gifting circle?

Gifting circles are pyramid schemes and participating in them is illegal. In many instances, the person asking you to join could be someone you know who is a member of a group that is active on the Internet or in certain circles. Initially, you may not be told that you’ll have to recruit more members to make a lot of money. The person will begin by drawing you in with a project you might find interesting and then tempt you with the possibility of making a quick profit.

Gifting circles can take any number of forms devised by ill-intentioned promoters. For example, a circle could appear to be an investment or a community project, or offer you the chance to be your own boss. These circles go by many names, such as gift circle, women’s financial circle, dinner party, or pay-it-forward cloud.

Despite promoters’ claims, and even if a group has a catchy name that provides a great cover, gifting circles are still pyramid schemes.

How it works

Have you been promised a profit on the money you gift? However, no part of the operation generates a profit. For someone to make money, another person has to pay into the scheme.

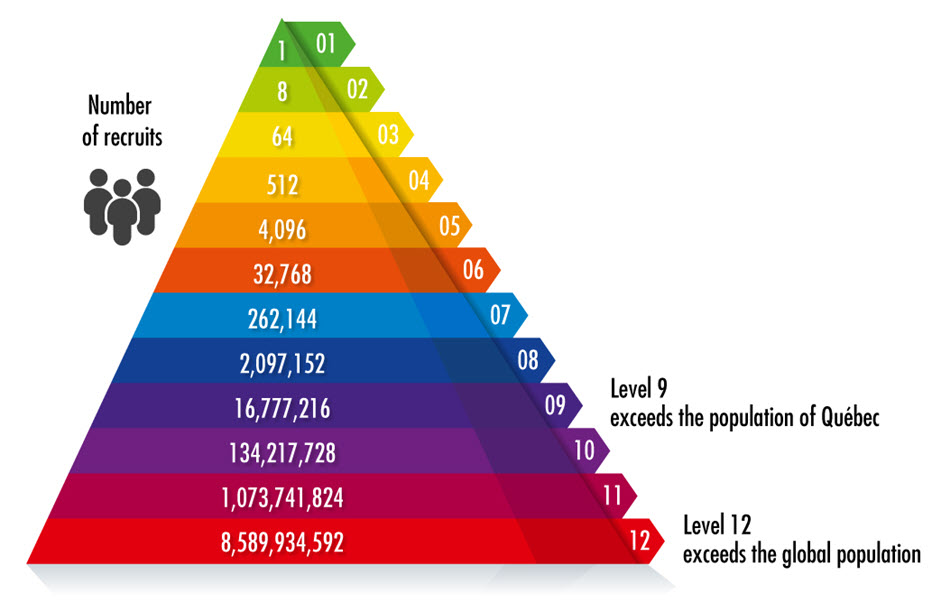

Generally speaking, anyone who joins a gifting circle has to recruit eight other members, who will have to contribute $5,000 each. Only once the recruitment is completed will the person pocket the $40,000, often at a circle members meeting. Recruits would in turn each receive $40,000 when they bring in eight other members willing to pay $5,000 each. That’s a lot of people and it’s only the tip of the iceberg!

The following chart shows the number of recruits needed to prevent the pyramid from collapsing.

Watch out for the following situations:

- You ask where the amounts you could receive will come from. If revenues are based only on member recruitment, that’s illegal. It’s really a pyramid scheme. Not only is it against the law to set up this kind of scheme, it’s also against the law to participate in it!

- You’ve been promised a big profit for little or no effort. It’s too good to be true.

- You’re encouraged to use a fake name to participate.

- You’re asked to pay in cash.

- You’re strongly advised not to miss out on this opportunity. Your emotions are being manipulated.

There are ways for you to avoid these types of frauds

- To reduce your chances of falling for this type of fraud, don’t be taken in by fancy words or by web testimonials or offers that seem just too good to be true. If you have any doubts, contact the AMF or the police.

- Be careful if someone promises you money to recruit new people, whether the fraudsters refer to them as investors, partners, associates or by some other term.

- The people who orchestrate pyramid schemes and those who participate in them may be prosecuted.

- Don't believe the ads that tout foolproof ways to get rich quick.

- Be cautious if you are guaranteed high, risk-free returns.

- Research the investment product you are being offered

- Don’t be fooled because someone told you that it’s legal, that a loophole in the law makes the operation legal, or even that a police officer or the AMF has approved it. All of these statements are false!

- Always check whether the person and firm offering you an investment are authorized to do so. When in doubt, contact our Information Centre.