Deposit protection What conditions must be met to qualify for it? What deposits are protected?

In Québec, the deposits made with various financial institutions are protected by the AMF and the Canada Deposit Insurance Corporation (CDIC) This link will open in a new window, which means you won’t lose your money if your financial institution ever goes bankrupt.

The AMF will repay eligible deposits made with Québec authorized deposit institutions, namely:

- Each Desjardins caisse in Québec and the Fédération des caisses Desjardins du Québec

- National Bank Trust Inc.

- Beneva inc.

- Caisse Ma Financière Prêts et Placements

The CDIC will repay eligible deposits made at its member institutions, such as federal banks and financial institutions. Visit the CDIC website This link will open in a new window to find out whether your institution is a CDIC member and learn more about the CDIC’s deposit insurance, which is similar to the deposit protection provided by the AMF.

Your money is safe

Find out which categories of deposits are protected if your financial institution goes bankrupt:

What is it?

Your deposits are protected up to a maximum of $100,000 per category of deposit, per authorized deposit institution, including principal and accrued interest.

Deposits that are protected

Deposits of money made and payable in Québec, whether in Canadian dollars or any other currency (e.g., U.S. dollars).

The most common deposits are:

- deposits held in chequing accounts and savings accounts

- term deposits and Guaranteed Investment Certificates (GICs)A guaranteed investment certificate (GIC), also called a certificate of deposit or term deposit, is a security indicating that an investor has lent money to a financial institution. GICs earn interest.

- drafts and certified cheques

Deposits that are not protected

Because they do not meet the conditions for a deposit of money, some savings products are excluded from deposit protection. For example:

- sharesA share, also referred to as stock, is an equity security that entitles you to an ownership interest in a company.

The company can distribute a portion of its earnings to shareholders by paying them a dividend.

The shares of companies listed on an exchange are bought and sold at the exchange.

When a company ceases to operate, the proceeds from the sale of its assets are used to pay its debts and taxes, and the rest of the money is distributed to shareholders., mutual fundsA mutual fund is made up of money that is pooled by several investors and used on their behalf by a manager to buy shares, bonds or other securities in line with the fund’s objectives. , bondsA bond is a security issued by governments and companies through which an investor lends money to the issuer.

In general, the government or company promises to pay the investor interest at a fixed rate and at certain intervals (for example, 2% per year). Interest is normally paid twice a year. At maturity, the government or company pays back a predetermined amount that is called the face value. The face value is usually $1,000.

There are several types of bonds:

Stripped bondReal return bondConvertible bondSavings bondRetractable bondUnsecured bondEtc. , debenturesA debenture is a fixed-income investment, similar to bonds, except that debentures are generally not backed by specific assets. Also called unsecured bond., mortgage-backed securitiesA mortgage-backed security is a type of security tied to a mortgage.

A mortgage loan (a loan secured by a mortgage) is a mortgage-backed security. and units/shares or other equity securities - Treasury billsA treasury bill is a short-term investment guaranteed by a government. It reaches maturity within a year at most. At maturity, the government pays out a greater amount than the amount invested.

- life insurance contracts and segregated fundsA segregated fund is a fund issued by insurers. It is similar to a mutual fund, but has additional guarantees. For example, capital may be reimbursed in the event of death, even if your investments have declined in value.

- crypto-assets or cryptocurrencyVirtual currency, used to exchange goods or services on a peer-to-peer basis, usually independently of the banking system or any monetary policy, whose issuance and transactions are based on blockchain technology.

Some products may be eligible for other protection programs. For more information, visit http://financeprotection.ca This link will open in a new window.

How are deposits repaid?

If an institution goes bankrupt, the AMF will repay the protected deposits. Most deposits will be repaid within 7 business days following the bankruptcy.

The repayment of protected deposits is automated, with the AMF making a payment using data received from the institution. With certain exceptions, depositors do not need to contact the AMF or provide supporting documents in order for their protected deposits to be repaid.

The repayment of transaction account deposits will be given priority, so that you receive the funds you need for your daily activities as quickly as possible.

Your money is safe

A financial institution whose deposits are eligible for the deposit protection provided by the AMF displays the official logo at the entrance to and inside its establishments. This logo is also displayed when you make a deposit through technological means, including an automated teller machine, a mobile application or a transactional website.

Your financial institution must tell you about the features of the deposit protection provided by the AMF before opening a deposit account or giving you a document evidencing receipt of your deposit of money. For example, your financial institution could give you a copy of the brochure “Your deposits are protected. That’s a guarantee! (pdf - 208 KB)This link will open in a new windowUpdated on April 28, 2023In Québec, the money you deposit in an authorized deposit institution will be repaid to you by the Autorité des marchés financiers (AMF) if the institution goes bankrupt. This deposit protection is automatic and doesn’t cost you anything.”.

For greater clarity, if your deposit institution is eligible for the deposit protection provided by the AMF, the documents it provides evidencing receipt of your funds must contain the following statement: “This is a deposit of money within the meaning of the Deposit Institutions and Deposit Protection Act”.

The maximum amount is set at $100,000 per category of deposits, per person and per authorized deposit institution, and includes the principal and accrued interest.

For example, if you hold a $95,000 investment with a single institution and it earns $7,000 in interest for a total of $102,000, the protection provided by the AMF will be $100,000.

Other examples

- If you make three eligible $50,000 deposits with three different authorized deposit institutions, each deposit, or a total of $150,000, will be protected.

- You have a deposit in U.S. dollars. It is eligible for the protection offered by the AMF up to a maximum of CDN$100,000.

If you have deposits in Canadian dollars and deposits in foreign currency in a category of deposits, the deposits are protected up to CDN$100,000. For example, you have US$50,000 and CDN$50,000 in deposits of money in your TFSA with an authorized deposit institution. If the USD to CAD exchange rate were 1.25, your deposits would total CDN$112,500 (US$50,000 x 1.25 = CDN$62,500 + CDN$50,000), which, for the TFSA category, would be protected up to CDN$100,000.

Amalgamation of several authorized institutions

If authorized deposit institutions amalgamate (for example, Desjardins caisses), your deposits that were protected with the former institutions will continue to be protected with the new institution as if no amalgamation had taken place.

For example, if you hold an $80,000 deposit with institution A and a $40,000 deposit with institution B and the two institutions amalgamate, the amount protected will be $120,000 until the deposits reach maturity or are withdrawn.

Deposits made with the new institution following the amalgamation will be protected to the extent that your combined pre-amalgamation and post-amalgamation deposits do not exceed $100,000. For example, if you hold $120,000 in pre-amalgamation deposits and you make a new $10,000 deposit, the new deposit will not be protected, since the $100,000 limit will have already been reached.

Individuals (including minors)

The protection applies to all deposits belonging to an individual that are held with the same institution. For example, the protection applies to accounts that are held by:

- you personally.

- you and a sole proprietorship owned by you. A firm’s registration in the Registre des entreprises (REQ)

This link will open in a new window contains information about its legal form. A sole proprietorship does not create a legal person separate from its owner. The deposits of the sole proprietorship and those of its owner, even if they are made to separate accounts, are combined when calculating the maximum deposit protection amount.

- you personally and all the accounts for which you are the account owner. For example, if you’re the signatory on the transaction account (account owner) of an association, the association’s deposits and your deposits, even if they are made to separate accounts, are combined when calculating the maximum deposit protection.

Legal persons

A legal person is constituted under a law and has a legal personality separate from that of its owner or owners. An entreprise’s registration in the Registre des entreprises (REQ) This link will open in a new window contains information about its legal form. Examples of legal persons include companies constituted under a Québec law, including the Business Corporations Act, or cooperatives constituted under the Act respecting financial services cooperatives. There are also other forms of legal persons, such as non-profit organizations.

Groups of persons

You may belong to one or more groups of persons (e.g., you and your spouse, you and your child, you and your parents, you and your fellow partners An enterprise’s registration in the REQ This link will open in a new window This link will open in a new window contains information about its legal form. General partnerships, limited partnerships and undeclared partnerships are not legal persons separate from their partners. These types of partnerships are established by persons who agree to engage in an activity and share in its profits). The deposits of each group of persons are protected to a maximum of $100,000. “Jointly held deposits” are deposits held by a group of persons whose names are noted in the records of the authorized deposit institution.

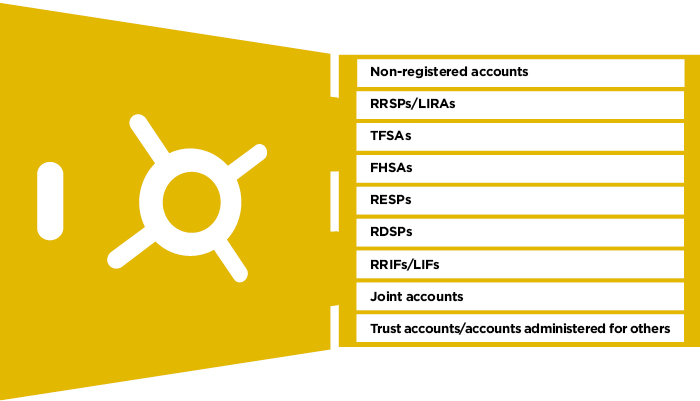

Deposits of money in chequing and savings accounts and term deposits are protected. These deposits may be made in regular accounts or in savings plans such as RRSPs or TFSAs or placed for the benefit of other persons in special accounts such as trust accounts.

Protection that is calculated by category of deposits

Your deposits, where made with an authorized deposit institution, are protected up to a maximum of $100,000 in each of the following categories:

- Non-registered accounts (chequing or transaction account, savings account, term deposit or GIC).

- Registered Retirement Savings Plans (RRSPs), including deposits in a Locked-In Retirement AccountA Locked-In Retirement Account (LIRA) is generally used for investing money coming from a Supplemental Pension Plan (SPP). The income generated by the investments in a LIRA is not taxable as long as it remains in the LIRA. To move money out of a LIRA, it must either be transferred to a Life Income Fund (LIF) or used to buy a life annuity from an insurance company. (LIRA).

- Tax-Free Savings Accounts (TFSAs).

- Tax-Free First Home Savings Accounts (FHSA).

- Registered Education Savings Plans (RESPs).

- Registered Disability Savings Plans (RDSPs).

- Registered Retirement Income FundsA Registered Retirement Income Fund is a plan that allows participants to defer taxes on investment income. The funds held in a RRIF are usually transferred from an RRSP.

Unlike with an RRSP, participants in a RRIF must withdraw a minimum amount each year (as with a LIRA).

Amounts withdrawn are taxable, as with an RRSP. (RRIFs), including deposits in a Life Income FundA Life Income Fund (LIF) is a fund whose purpose is to provide income for the rest of a participant’s lifetime.

The holder of this type of fund is required to withdraw a minimum amount of money every year, without exceeding the limit.

Funds invested in a LIF are often derived from an employer’s pension plan (Supplemental Pension Plan).

As with an RRSP:

Investment income earned in a LIF is not taxable as long as it remains in the fund.Amounts withdrawn are taxable. (LIF). - Joint accounts that you hold with a particular person or group of persons.

- Trust accountsIn the context of a trust, the trustee is the person who undertakes to hold and administer the assets in the trust on behalf of one or more other individuals or companies. or accounts administered for othersAn administrator of the property of others is a person who manages property on behalf of another person. For example, an investor instructs his or her lawyer to perform a transaction on his or her behalf. where the existence of the trust or form of administration is noted in the records of the institution.

In this case, it is the trust or the form of administration of the property of others that benefits from the protection. Each beneficiary of a trust or each person whose deposits are administered by others is entitled to protection up to $100,000.

In addition, in order for a person to be able to benefit from the protection for a form of administration of the property of others, their property must be managed in connection with a business activity or liquidation activity. Merely entrusting management of a deposit to someone else (e.g., under a power of attorney or a mandate in anticipation of incapacity (protection mandate)) does not entitle a person to the $100,000 protection for a form of administration of the property of others.

Documentation and tools

-

Your deposits are protected. That's a guarantee!

(pdf - 208 KB)

This link will open in a new windowUpdated on April 28, 2023

-

Deposit Insurance in Québec 1967 to 2017

(pdf - 3 MB)

This link will open in a new windowUpdated on October 12, 2017

-

Choosing Investments!

(pdf - 1 MB)

This link will open in a new windowUpdated on June 17, 2022