The role of the AMF in deposit protection

To foster a healthy and dynamic financial sector and financial stability in Québec, the AMF controls financial institutions’ right to practise and regulates and supervises their activities. It also administers deposit protection.

Controlling the right to practise and authorizing institutions to solicit and receive deposits in Québec

The AMF ensures that financial institutions hold the necessary authorizations to operate in Québec. For example, deposit institutions authorized by the AMF may solicit or receive deposits of money from the public in Québec.

Check the Register – Insurers, Deposit Institutions and Trust Companies to determine whether your financial institution is authorized to operate in Québec. Note that banks are regulated by the Office of the Superintendent of Financial Institutions This link will open in a new window (OSFI) and are therefore not listed in the AMF’s register.

Regulating financial institutions

The AMF oversees all the activities of financial institutions that carry on business in Québec, excluding banks. It applies, revises and updates the framework applicable to financial institutions (laws, regulations, guidelines, etc.) based on developments in the financial sector and best practices stemming from recognized international principles. The purpose of the framework is to ensure that financial institutions adhere to good commercial and management practices and maintain capital, reserve and liquidity levels aligned with the AMF’s expectations.

Specific case: Desjardins Group – systemically important financial institution for Québec

Certain financial institutions play such a significant role in their respective markets that their failure could trigger a crisis that affects financial stability. These institutions are designated as “Systemically Important Financial Institutions” (SIFIs). In Québec, Desjardins Group is designated as a SIFI.

SIFIs are subject to additional requirements that are tailored to their situation. For example, they must hold additional capital (or reserves) to absorb losses in the event of a crisis and support their survival. They are also subject to additional disclosure requirements.

For more information, refer to:

the additional requirements for SIFIs on the Guidelines - Deposit institutions page, particularly under “Pillar 3 disclosure requirements” and “Total loss absorbing capacity.”

Supervising financial institutions

The AMF supervises the financial health and management of the financial institutions it regulates to assess the associated risks. It ensures that the institutions are solvent and properly managed, adhere to sound commercial practices and maintain sufficient liquidity. The results of the AMF’s supervisory activities, including any recommendations it may have, are communicated to the institutions, which, if deficiencies have been identified, must present action plans to address them.

The purpose of the AMF’s supervision is to quickly detect issues that may affect an institution. The AMF strives to intervene with institutions in a timely manner according to how serious the situation is. Institutions in a distressed financial condition or with inappropriate management or commercial practices will be required by the AMF to implement targeted action plans, the effectiveness of which will be monitored by the AMF. The more the institution’s financial condition deteriorates, the more the AMF will increase its intervention efforts.

Specific case: Desjardins Group – systemically important financial institution for Québec

Since the financial difficulties or insolvency of a SIFI could have a significant impact on financial stability, the AMF supervises Desjardins Group more intensively. The AMF also requires that it adopt a recovery plan to deal with a potential major crisis. This plan includes the strategies that Desjardins Group would implement to continue its operations and remain viable.

For more information, refer to:

- the Financial Institutions Supervisory Framework (pdf - 795 KB)

This link will open in a new windowUpdated on December 17, 2020The Autorité des marchés financiers (the “AMF” or the “Authority”) is the body mandated by the Québec government to regulate Québec’s financial sector and assist consumers of financial products and services, in particular in the areas of insurance, securities, derivatives, deposit institutions – other than banks – the distribution of financial products and services and, since May 1, 2020, mortgage brokerage.;

- the Intervention Guidelines for Québec-Chartered Deposit Institutions (pdf - 1 MB)

This link will open in a new windowUpdated on March 6, 2014""Intervention, Guidelines, Deposit Institutions, Deposit Insurance Act"";

- le Annual Report on Financial Institutions (available in French only), which discusses issues such as current and emerging risks faced by financial institutions carrying on business in Québec and the regulatory and supervisory actions taken by the AMF. The report includes information on the financial condition of those institutions.

Preparing resolution plans

The insolvency of an authorized deposit institution may happen despite the AMF’s oversight and supervision and the institution’s recovery plans.

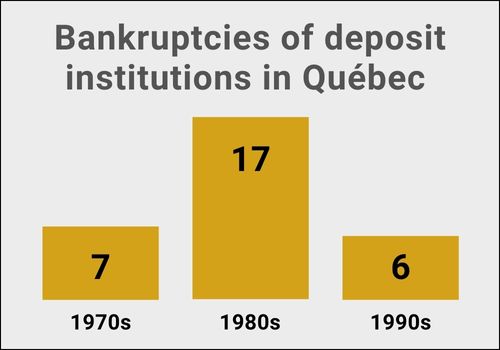

To find out more about what actions were taken and how bankruptcies were resolved in the past, refer to Deposit Insurance in Québec – 1967 to 2017 and Les trente ans d’histoire de la Régie de l’assurance-dépôts du Québec (in French only).

Even though it is rare for a deposit institution to become insolvent and the last time one went bankrupt was over 25 years, the AMF must be ready to intervene to protect depositors and minimize the economic and financial impact on Québec. In preparation for such an eventuality, the AMF drafts plans containing a set of measures to respond to and resolve the bankruptcy of an institution.

Specific case: Desjardins Group – systemically important financial institution for Québec

The AMF has adopted a plan to resolve a potential crisis that could compromise the survival of Desjardins Group and the continuity of activities essential to the daily lives of thousands of Quebeckers. This resolution plan sets out the strategy to be implemented to resolve the problems of Desjardins Group.

Resolving the insolvency of an authorized deposit institution

The resolution strategy takes into account the context and market conditions that led to the institution’s insolvency. The strategy may include any of the following intervention measures:

- Helping with the institution’s recovery by making advances of money or loans to the institution, guaranteeing payment of its debts, or acquiring assets or securities

- Providing various guarantees or financial assistance to a purchaser for the sale or amalgamation of the institution, or applying to the Court to force an amalgamation

- Temporarily administering a distressed institution

- Winding up the institution and repaying the protected deposits

Specific case: Desjardins Group – systemically important financial institution for Québec

To resolve the insolvency of Desjardins Group, the AMF may apply the intervention measures available for other authorized deposit institutions. However, additional actions are applied to maintain activities that are systemically important for Québec’s financial sector.

After the resolution plan is triggered, the AMF may, among other things, take the following additional actions:

- Convert the debt provided for such purpose into capital shares in order to rescue Desjardins Group (bail-in)

- Amalgamate all Desjardins Group caisses in order to constitute a single entity (Québec savings company)

- Require that suppliers maintain services that are critical to the continuity of Desjardins Group’s activities

Funding the interventions and resolution of the bankruptcy

The AMF gets its funding from the Deposit Insurance Fund (DIF). When the resources are insufficient, the government of Québec may make or guarantee advances of money.

Deposit insurance fund

The DIF is made up of the deposit insurance premiums paid by the authorized deposit institutions as well as investment income. The investment portfolio is managed by the Caisse de dépôt et placement du Québec (CDPQ). If necessary, the CDPQ quickly provides liquidity to the AMF. Refer to the most recent AMF annual report for more information about the DIF.

Government of Québec

When the amounts in the DIF are insufficient for the payment of the AMF’s obligations, the AMF may obtain advances from the government of Québec. The advances made by the government are considered temporary and a last resort. The government may also choose to guarantee any loan to the AMF from another institution, particularly the Canada Deposit Insurance Corporation under an agreement entered into in 1969.

Specific case: Desjardins Group – systemically important financial institution for Québec

Desjardins Group may also be eligible for emergency lending assistance (ELA) from the Bank of Canada This link will open in a new window. ELA is a last-resort loan or advance that the Bank of Canada provides, at its discretion and subject to collateral commitments, to eligible financial institutions that are facing serious liquidity problems. A credible recovery and resolution framework is one of the eligibility criteria for ELA. Such assistance to Desjardins Group could serve to support the intervention of the AMF and the resolution of the financial institution should it become insolvent.

Documentation and tools

Choosing Investments (pdf - 1 MB)This link will open in a new windowUpdated on June 17, 2022